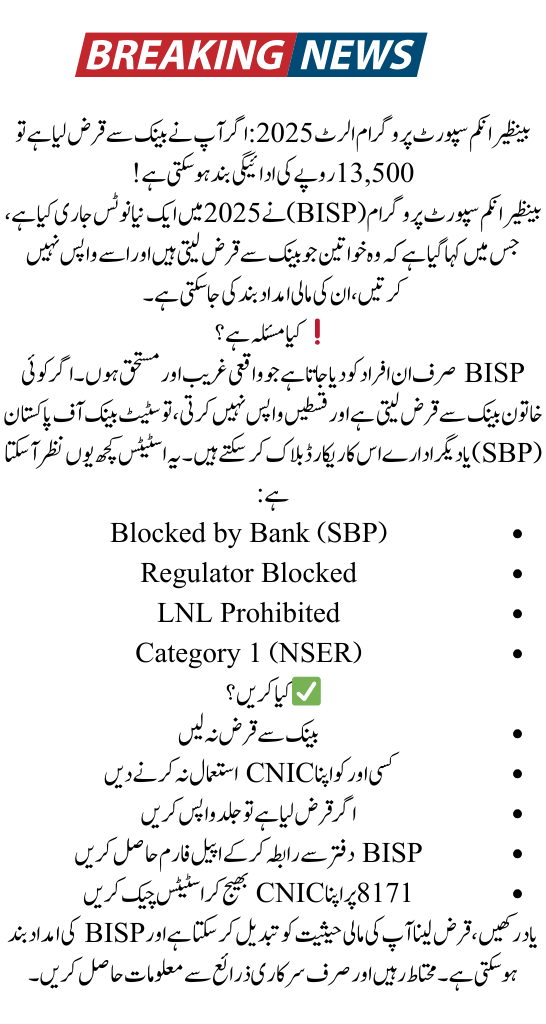

The Benazir Income Support Programme (BISP) has issued a new warning for all current and future beneficiaries in 2025. If you’re getting the Rs. 13,500 quarterly payment and you’ve taken a bank loan—you could be at risk of losing your aid!

This alert is part of BISP’s new verification process to make sure the financial support reaches only truly deserving families. If you’re a BISP recipient or planning to apply, here’s everything you need to know.

Why BISP is Blocking Payments Over Bank Loans

The government has found that some BISP beneficiaries have taken loans from banks and microfinance institutions but failed to repay them. When this happens, it flags your financial profile as “risky” or “active” — something not allowed for a BISP recipient.

BISP is strictly for the most financially vulnerable families. If someone has a history of bank loans or commercial financial activity, it raises questions about their eligibility.

What Categories Can Get You Blocked?

Here are some of the warning terms you might see when checking your BISP status:

-

Category 1 (NSER) – Your household data is under review or inconsistent.

-

Blocked by Bank (SBP) – Your CNIC is reported for unpaid bank loans.

-

Regulator Blocked – A government body like SBP or NADRA has paused your eligibility.

-

LNL Prohibited – You’re listed under Loan Non-Repayment List, triggering an automatic block.

If any of these appear in your profile, you may not receive your payment.

Also Read: 8171 BISP 13500 ATM Withdrawal Through 6 Authorized Banks 2025

What BISP Recipients Should Avoid

To keep receiving your BISP payments without issues:

-

Don’t take personal or business loans from any bank or microfinance service.

-

Avoid credit cards, car financing, or buying anything on installments.

-

Don’t share your CNIC with others for financial transactions.

-

Keep your NSER survey details up to date and accurate.

-

Always check your PMT score and avoid financial behavior that may increase it.

What to Do If Your BISP is Already Blocked

If your Rs. 13,500 payment is stopped, don’t worry. You can take steps to fix it:

-

Visit your nearest BISP Tehsil Office.

-

Ask for a data correction or appeal form.

-

Bring your original CNIC, NSER slip, and any loan clearance document (if applicable).

-

If you had a loan, pay it back and get a clearance letter from the bank.

-

Keep checking your status by sending your CNIC to 8171 or visiting 8171.bisp.gov.pk.

Final Advice

The new BISP Alert 2025 is serious. If you’re receiving BISP support, don’t put it at risk by taking out a loan. Keep your records clean and your CNIC safe. The government wants to help—but only if you follow the rules.

Stay informed. Stay eligible. And don’t lose your 13,500 payment!