Farmers in Pakistan face rising costs of fertilizer, seed, machinery, fuel, and irrigation. To support growers in 2025, the government and banks have introduced low-markup agriculture loan 2025 schemes. These farm loan low markup options make it easier for small farmers to get financial help.

This full guide covers government agri loan policies, bank-wise loan list, eligibility, documents, agriculture loan calculator Pakistan, and easy approval tips.

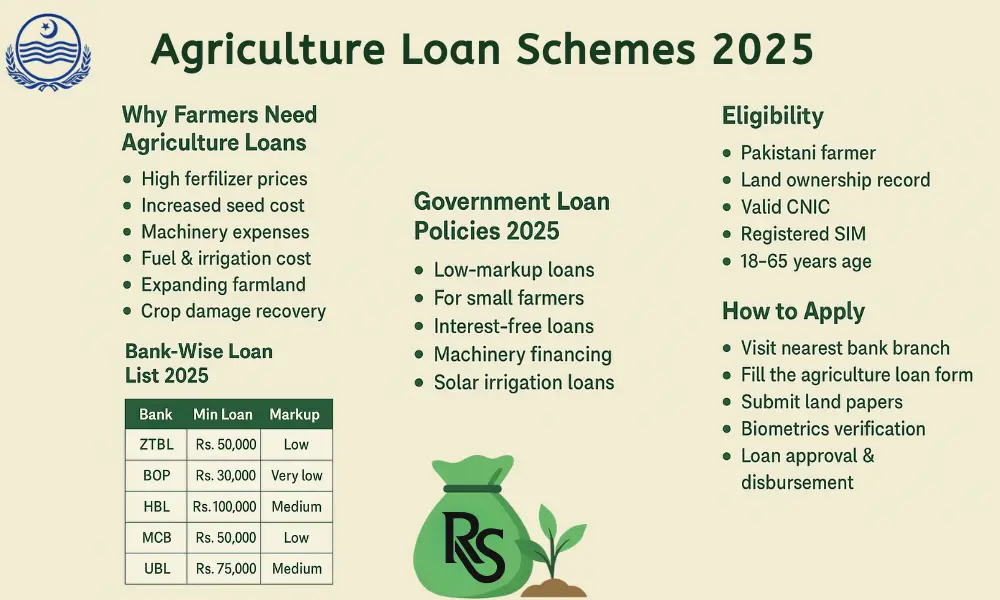

🌾 Why Farmers Need Agriculture Loans?

Farmers usually need agri loan Pakistan for:

High fertilizer prices

Expensive seeds

Buying or repairing machinery

Fuel and irrigation cost

Increasing farmland

Recovery after crop damage

Modern farming tools

🏦 Government Policies For Agriculture Loan 2025

In 2025, the Government agriculture loan Pakistan 2025 policies include:

Low-markup loans for small farmers

Interest-free loans under special schemes

Machinery financing (tractors, tools)

Solar irrigation loans

Kisan Card loan facility

Fast digital verification system

These steps directly support farmer subsidy Pakistan 2025 programs.

🏛️ Bank-Wise Agriculture Loan List 2025

| Bank | Minimum Loan | Markup | Details |

|---|---|---|---|

| ZTBL | Rs. 50,000 | Low | Best for small farmers |

| BOP | Rs. 30,000 | Very low | Kisan Card loan |

| HBL | Rs. 100,000 | Medium | Good for big farmers |

| MCB | Rs. 50,000 | Low | Machinery loans |

| UBL | Rs. 75,000 | Medium | Easy documentation |

| Al Baraka | Rs. 50,000 | Islamic | Crop financing |

This table helps you choose the best bank for agriculture loan in Pakistan in 2025.

🧾 Eligibility

To apply for agriculture loan 2025, you must have:

Pakistani nationality

Land record (Fard)

Valid CNIC

Registered SIM

Age 18–65

Bank account (optional)

📄 Required Documents

CNIC copy

Land ownership record (Fard)

2 passport-size photos

SIM registered on same CNIC

Bank loan form

📝 How to Apply for Agriculture Loan 2025

Follow these steps to agriculture loan apply Pakistan:

Visit nearest bank branch

Fill agriculture loan form

Submit land documents

Complete biometric verification

Bank may inspect land

Loan approval & cash transfer

🧮 Agriculture Loan Calculator Pakistan (Simple Example)

If the loan is Rs. 100,000

Markup = 8% per year

Annual markup = Rs. 8,000

Monthly installment = Rs. 9,000–10,000

This simple agriculture loan calculator Pakistan estimate helps farmers plan better.

🏅 Government Markup Subsidy

Government provides:

25%–100% markup relief

Solar pump financing subsidy

Seed & fertilizer financing

Interest-free loans via Kisan Card

A major part of subsidy loan for farmers in 2025.

⭐ Best Bank Recommendation (2025)

⏳ Loan Timing & Approval Tips

Keep land record updated

SIM must match CNIC

Don’t apply in multiple banks

Choose bank by crop & region

Answer bank calls quickly

❓ FAQs Of Agriculture Loan 2025

Q1: What is the lowest markup agriculture loan in Pakistan 2025?

BOP and ZTBL offer the lowest markup loans under farm loan low markup schemes.

Q2: Which bank is best for small farmers in 2025?

ZTBL and BOP are the best bank for agriculture loan in Pakistan for small farmers.

Q3: Can farmers get interest-free loans in 2025?

Yes, under government agri loan and Kisan Card plans, small farmers can get interest-free loans.

Q4: What documents are required?

CNIC, Fard, SIM on same CNIC, photos, and bank loan form.

Q5: How long does agriculture loan approval take?

Usually 3–10 days, depending on verification.

🟩 Final Words

Agriculture Loan 2025 Schemes bring real relief for Pakistani farmers through low-markup, easy, and fast loans.

By keeping documents updated and choosing the right bank, farmers can reduce costs, boost crop production, and upgrade farming tools for better Farming.

Mujtaba is a verified content writer at WSP2025Punjab.pk, known for publishing easy-to-understand guides on Pakistani Government Programs. His simple Urdu-English articles help families stay updated on BISP, Ehsaas, and Punjab Welfare Schemes.